Palladium One Intersects Widest Intercept to Date Southwest of the Kaukua Open Pit Resource Estimate, Finland, 1.6 g/t Pd_Eq over 121 Meters

Highlights

- Widest ore grade intercept to date, intersected 250 meters southwest and down plunge of the current Kaukua Open Pit Mineral Resource Estimate (“MRE”).

- 2.1 g/t Palladium Equivalent (Pd_Eq) over 33.5 meters, within 1.6 g/t Pd_Eq over 121.1 meters, in hole LK21-105, with individual samples grading up to 16.0 g/t Pd_Eq over 0.6 meters.

- Three holes (LK21-101, 102 and 105), spread over 220-meters laterally, have all intersected the down plunge, high-grade 'Core Zone' of the current pit constrained Kaukua Open Pit.

- High-grade 'Core Zone' of the Kaukua Open Pit remains open to depth.

January 11, 2021 – Toronto, Ontario, Initial down plunge drilling, has intersected the widest ore-grade intercept to date, southwest of the 2019 open-pit constrained MRE of the Kaukua Deposit. Hole LK21-105 intersected 2.1 g/t Pd_Eq over 33.5 meters, within 1.6 g/t Pd_Eq over 121.1 meters, starting at a true depth of approximately 260 meters (Figure 2), said Palladium One Mining Inc. (“Palladium One” or the “Company”).

Derrick Weyrauch, President and CEO commented: “We have extended the 'Core Zone' of the Kaukua Deposit 250 beyond the current conceptual open-pit and hole LK21-105 is among the thickest intercepts to date within the Kaukua Deposit and adds significant tonnage to our existing resource endowment. The high-grade 'Core Zone' of the Kaukua Deposit remains open to the southwest for more expansion. An updated NI43-101 Mineral Resource Estimate is schedule for release in Q1 2022 and will incorporate these valuable results”

These drilling results extend a broad, >200-meter wide 'core zone' of mineralization 250-meters southwest of the existing conceptual open-pit, and it remains open for expansion (Figure 1 and 2, and 3). Importantly, the previous geological interpretations suggested that the Kaukua Deposit was cut-off by a northwest trending fault, occupying a distinct magnetic low and topographic lineament. Drilling has now demonstrated that the magnetic low is the result of a later cross cutting dyke (now referred to as the high-titanium gabbro dyke) and that the Kaukua Deposit remains open to the south. Significantly the high-grade 'Core Zone' of the Kaukua Deposit has been extended 250 meters to the southwest and we have encountered some of the thickest intercepts (>100m) to date within the deposit (see news release November 23, 2021).

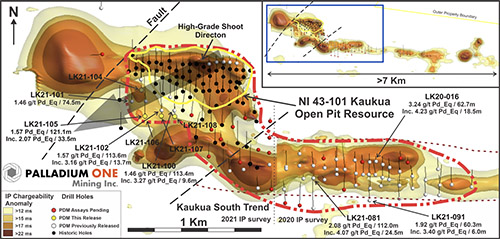

Figure 1. Historic and current drilling in the Kaukua area having a drill data cut-off date of September 30, 2021 (hole LK21-137), assays have been received for holes up to LK21-108, the remainder are pending. Background is Induced Polarization (“IP”) Chargeability.

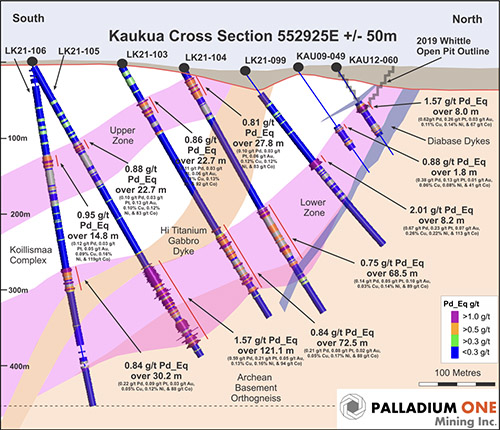

Figure 2. Cross sections showing holes LK21-099, 103, 104, 105 and 106 and historic holes KAU09-049 and KAU12-060, and their position with respect to the 2019 Kaukua Mineral Resource Estimate Whittle Open Pit.

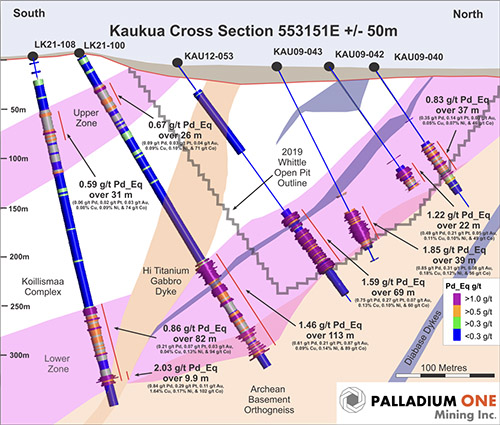

Figure 3. Cross section showing holes LK21-100, 108, historic holes KAU09--040, 042, 043, KAU12-053 and their position with respect to the 2019 Kaukua Whittle Open-Pit constrained Mineral Resource Estimate.

Table 1. LK Project, select Kaukua Drill Hole Results

| Hole |

From (m) |

To (m) |

Width (m) |

Pd_Eq g/t* In-Situ |

Pd_Eq g/t* Estimated Recovered |

PGE (Pt+Pd+Au) |

Pd g/t |

Pt g/t |

Au g/t |

Cu % |

Ni % |

Co g/t |

|

LK21-100 Upper Zone |

37.6 | 64.0 | 26.4 | 0.67 | 0.42 | 0.16 | 0.09 | 0.03 | 0.04 | 0.09 | 0.10 | 71 |

| Inc. | 37.6 | 42.0 | 4.4 | 1.03 | 0.67 | 0.38 | 0.21 | 0.09 | 0.07 | 0.14 | 0.13 | 74 |

| Lower Zone | 246.2 | 359.5 | 113.4 | 1.46 | 0.93 | 0.87 | 0.61 | 0.21 | 0.04 | 0.09 | 0.14 | 89 |

| Inc. | 246.2 | 284.5 | 38.4 | 2.03 | 1.33 | 1.30 | 0.91 | 0.32 | 0.07 | 0.14 | 0.17 | 95 |

| Inc. | 249.5 | 259.0 | 9.6 | 3.27 | 2.21 | 2.25 | 1.54 | 0.54 | 0.17 | 0.27 | 0.21 | 111 |

| Inc. | 249.5 | 254.0 | 4.6 | 4.02 | 2.71 | 2.82 | 1.94 | 0.68 | 0.21 | 0.30 | 0.26 | 121 |

| And | 330.8 | 338.0 | 7.2 | 2.99 | 2.03 | 2.31 | 1.69 | 0.53 | 0.08 | 0.18 | 0.16 | 85 |

| Inc. | 330.8 | 335.0 | 4.2 | 3.98 | 2.71 | 3.20 | 2.35 | 0.75 | 0.10 | 0.21 | 0.19 | 98 |

| Inc. | 330.8 | 332.0 | 1.2 | 5.65 | 3.85 | 4.65 | 3.50 | 1.01 | 0.14 | 0.25 | 0.25 | 132 |

| And | 351.0 | 359.5 | 8.5 | 2.73 | 1.81 | 1.87 | 1.31 | 0.49 | 0.07 | 0.19 | 0.20 | 105 |

| Inc. | 358.0 | 359.5 | 1.5 | 5.88 | 3.97 | 4.45 | 2.95 | 1.42 | 0.08 | 0.48 | 0.33 | 111 |

|

LK21-101 Upper Zone |

83.0 | 100.8 | 17.8 | 0.76 | 0.45 | 0.15 | 0.08 | 0.03 | 0.04 | 0.08 | 0.13 | 103 |

| Lower Zone | 272.6 | 347.1 | 74.5 | 1.46 | 0.94 | 0.72 | 0.49 | 0.17 | 0.06 | 0.13 | 0.16 | 92 |

| Inc. | 276.9 | 298.7 | 21.8 | 1.68 | 1.08 | 0.92 | 0.61 | 0.23 | 0.08 | 0.13 | 0.17 | 92 |

| Inc. | 290.6 | 298.7 | 8.1 | 2.49 | 1.67 | 1.52 | 1.00 | 0.36 | 0.16 | 0.24 | 0.20 | 93 |

| And | 325.4 | 345.0 | 19.6 | 2.22 | 1.47 | 1.19 | 0.81 | 0.28 | 0.10 | 0.24 | 0.21 | 106 |

| Inc. | 325.4 | 334.0 | 8.6 | 2.70 | 1.84 | 1.65 | 1.13 | 0.38 | 0.13 | 0.30 | 0.20 | 83 |

| Inc. | 333.0 | 334.0 | 1.0 | 4.15 | 2.77 | 1.51 | 1.03 | 0.29 | 0.19 | 0.70 | 0.48 | 177 |

|

LK21-102 Upper Zone |

62.8 | 82.5 | 19.7 | 0.68 | 0.42 | 0.16 | 0.09 | 0.03 | 0.04 | 0.09 | 0.10 | 76 |

| Lower Zone | 248.2 | 361.8 | 113.6 | 1.57 | 1.02 | 0.92 | 0.63 | 0.23 | 0.06 | 0.12 | 0.14 | 92 |

| Inc. | 291.5 | 361.8 | 70.3 | 1.85 | 1.22 | 1.15 | 0.80 | 0.29 | 0.07 | 0.15 | 0.15 | 90 |

| Inc. | 291.5 | 305.2 | 13.7 | 3.16 | 2.12 | 2.21 | 1.58 | 0.55 | 0.09 | 0.24 | 0.21 | 107 |

| Inc. | 296.0 | 299.0 | 3.0 | 4.22 | 2.79 | 3.07 | 2.22 | 0.77 | 0.08 | 0.21 | 0.30 | 141 |

| And | 348.7 | 361.8 | 13.1 | 3.04 | 2.04 | 2.03 | 1.39 | 0.51 | 0.12 | 0.26 | 0.21 | 104 |

| Inc. | 357.7 | 359.7 | 2.0 | 7.98 | 5.52 | 5.82 | 3.97 | 1.48 | 0.37 | 0.78 | 0.41 | 138 |

| Inc. | 358.7 | 359.7 | 1.0 | 9.56 | 6.64 | 7.08 | 4.81 | 1.83 | 0.44 | 0.95 | 0.46 | 150 |

|

LK21-103 Upper Zone |

54.3 | 77.0 | 22.7 | 0.88 | 0.55 | 0.27 | 0.10 | 0.03 | 0.13 | 0.10 | 0.12 | 83 |

| Inc. | 55.9 | 62.0 | 6.2 | 1.23 | 0.84 | 0.57 | 0.13 | 0.05 | 0.38 | 0.15 | 0.12 | 72 |

| Lower Zone | 248.0 | 343.5 | 95.5 | 0.75 | 0.45 | 0.29 | 0.20 | 0.07 | 0.02 | 0.05 | 0.11 | 78 |

| Inc. | 258.0 | 330.5 | 72.5 | 0.84 | 0.50 | 0.31 | 0.21 | 0.08 | 0.02 | 0.05 | 0.13 | 88 |

| Inc. | 258.0 | 275.0 | 17.0 | 1.19 | 0.72 | 0.49 | 0.35 | 0.12 | 0.03 | 0.07 | 0.17 | 108 |

| Inc. | 272.0 | 273.5 | 1.5 | 3.12 | 2.11 | 2.01 | 1.42 | 0.46 | 0.13 | 0.29 | 0.22 | 128 |

| And | 319.8 | 330.5 | 10.7 | 1.27 | 0.83 | 0.82 | 0.57 | 0.20 | 0.04 | 0.09 | 0.10 | 63 |

| Inc. | 326.0 | 329.0 | 3.0 | 2.18 | 1.44 | 1.39 | 0.97 | 0.33 | 0.08 | 0.16 | 0.18 | 82 |

|

LK21-104 Upper Zone |

15.3 | 43.0 | 27.8 | 0.81 | 0.51 | 0.18 | 0.10 | 0.03 | 0.06 | 0.12 | 0.12 | 83 |

| Inc. | 16.8 | 22.0 | 5.3 | 1.07 | 0.69 | 0.34 | 0.17 | 0.07 | 0.10 | 0.16 | 0.14 | 75 |

| Lower Zone | 209.5 | 278.0 | 68.5 | 0.75 | 0.42 | 0.20 | 0.14 | 0.05 | 0.01 | 0.03 | 0.14 | 89 |

| Inc. | 211.2 | 221.2 | 10.0 | 1.28 | 0.79 | 0.60 | 0.42 | 0.16 | 0.03 | 0.08 | 0.16 | 105 |

|

LK21-105 Upper Zone |

120.4 | 131.1 | 10.8 | 0.86 | 0.53 | 0.20 | 0.11 | 0.03 | 0.06 | 0.11 | 0.13 | 92 |

| Lower Zone | 304.3 | 425.3 | 121.1 | 1.57 | 1.01 | 0.85 | 0.59 | 0.21 | 0.05 | 0.13 | 0.16 | 94 |

| Inc | 321.0 | 323.7 | 2.7 | 3.13 | 2.15 | 2.12 | 1.53 | 0.49 | 0.10 | 0.31 | 0.18 | 116 |

| And | 344.0 | 346.9 | 2.9 | 4.34 | 2.92 | 2.69 | 1.85 | 0.66 | 0.18 | 0.43 | 0.33 | 160 |

| Inc. | 346.0 | 346.9 | 0.9 | 7.78 | 5.29 | 5.18 | 3.58 | 1.25 | 0.35 | 0.75 | 0.52 | 206 |

| And | 390.8 | 424.3 | 33.5 | 2.07 | 1.36 | 1.19 | 0.82 | 0.29 | 0.08 | 0.18 | 0.19 | 96 |

| Inc. | 407.7 | 418.9 | 11.3 | 2.56 | 1.65 | 1.37 | 0.97 | 0.32 | 0.09 | 0.21 | 0.27 | 116 |

| Inc. | 407.7 | 408.2 | 0.6 | 15.99 | 9.54 | 6.07 | 4.91 | 1.07 | 0.09 | 0.85 | 2.60 | 725 |

|

LK21-106 Upper Zone |

123.1 | 137.9 | 14.8 | 0.95 | 0.56 | 0.20 | 0.12 | 0.03 | 0.05 | 0.09 | 0.16 | 119 |

| Inc. | 129.0 | 130.5 | 1.5 | 1.50 | 0.94 | 0.43 | 0.26 | 0.06 | 0.12 | 0.17 | 0.22 | 138 |

| Lower Zone | 271.3 | 301.5 | 30.2 | 0.84 | 0.51 | 0.34 | 0.22 | 0.09 | 0.03 | 0.05 | 0.12 | 88 |

| Inc. | 271.3 | 277.0 | 5.7 | 1.34 | 0.82 | 0.59 | 0.40 | 0.16 | 0.03 | 0.10 | 0.17 | 119 |

|

LK21-107 Upper Zone |

86.3 | 107.0 | 20.7 | 0.70 | 0.42 | 0.14 | 0.08 | 0.03 | 0.04 | 0.09 | 0.11 | 82 |

| Inc. | 89.0 | 90.0 | 1.0 | 1.22 | 0.80 | 0.45 | 0.24 | 0.12 | 0.10 | 0.19 | 0.14 | 91 |

| Lower Zone | 253.5 | 262.6 | 9.1 | 0.77 | 0.53 | 0.17 | 0.12 | 0.05 | 0.01 | 0.19 | 0.08 | 75 |

| Inc. | 261.7 | 262.6 | 0.9 | 3.16 | 2.71 | 0.03 | 0.00 | 0.00 | 0.03 | 1.84 | 0.08 | 120 |

|

LK21-108 Upper Zone |

55.7 | 87.0 | 31.3 | 0.59 | 0.36 | 0.12 | 0.06 | 0.02 | 0.03 | 0.08 | 0.09 | 74 |

| Inc. | 77.2 | 79.3 | 2.1 | 1.15 | 0.78 | 0.24 | 0.12 | 0.03 | 0.08 | 0.26 | 0.14 | 98 |

| Lower Zone | 264.0 | 345.9 | 81.9 | 0.86 | 0.51 | 0.32 | 0.21 | 0.07 | 0.03 | 0.05 | 0.13 | 95 |

| Inc. | 265.5 | 277.2 | 11.7 | 1.21 | 0.73 | 0.56 | 0.41 | 0.13 | 0.03 | 0.05 | 0.16 | 106 |

| And | 336.0 | 345.9 | 9.9 | 2.03 | 1.34 | 1.24 | 0.84 | 0.29 | 0.11 | 0.16 | 0.17 | 103 |

| Inc. | 337.7 | 341.0 | 3.3 | 3.57 | 2.44 | 2.44 | 1.69 | 0.58 | 0.17 | 0.33 | 0.22 | 108 |

* Pd_Eq calculated using in-situ values and prices from the 2021 NI43-101 Haukiaho Mineral Resource Estimate; $1,600/oz Pd, $1,100/oz Pt, $1,650/oz Au, $3.50 Cu, and $7.50/lb Ni, and $20/lb Co. Limited historical metallurgical work on the Kaukua Deposit indicates final recoveries in the range of 73% Pd, 56% Pt, 78% Au, 91% Cu, 48% Ni and 48% Co and are used in the Estimated Recovered Pd_Eq grade calculation.

**Italicised orange highlighted results are previously released results see news release November 23, 2021.

Palladium Equivalent

The Company is calculating Palladium equivalent using US$1,600 per ounce for palladium, US$1,100 per ounce for platinum, US$1,650 per ounce for gold, US$3.50 per pound for copper, US$7.50 per pound for nickel, and $20 per pound cobalt consistent with the calculation used in the Company's September 2021 NI 43-101 Haukiaho Resource Estimate.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101

About Palladium One

Palladium One Mining Inc. (TSXV: PDM) is focused on discovering environmentally and socially conscious Metals for Green Transportation. A Canadian mineral exploration and development company, Palladium One is targeting district scale, platinum-group-element (PGE)-copper-nickel deposits in leading mining jurisdictions. Its flagship project is the Läntinen Koillismaa (LK) Project in north-central Finland, which is ranked by the Fraser Institute as one of the world's top countries for mineral exploration and development. LK is a PGE-copper-nickel project that has existing Mineral Resources. PDM's second project is the 2020 Discovery of the Year Award winning Tyko Project, a high-grade sulphide, copper-nickel project located in Canada. Follow Palladium One on LinkedIn, Twitter, and at www.palladiumoneinc.com.

ON BEHALF OF THE BOARD

“Derrick Weyrauch”

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company's expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.